How to calculate UAE Value Added Tax (VAT) penalty as per new Cabinet Decision No. 49 of 2021?

Federal Tax Authority (FTA) has over ruled previous provisions of administrative penalties for violation of VAT regulations and non payment of VAT liability. A new decision has been issued on 28th of April 2021 which replaces the Administrative Penalties table initially set out in Cabinet Decision no. 40 of 2017.

Much of penalties are either reduced or spread over longer period of time in this new regulation, Cabinet Decision no. 49 of 2021, Redetermination of Administrative Penalties.

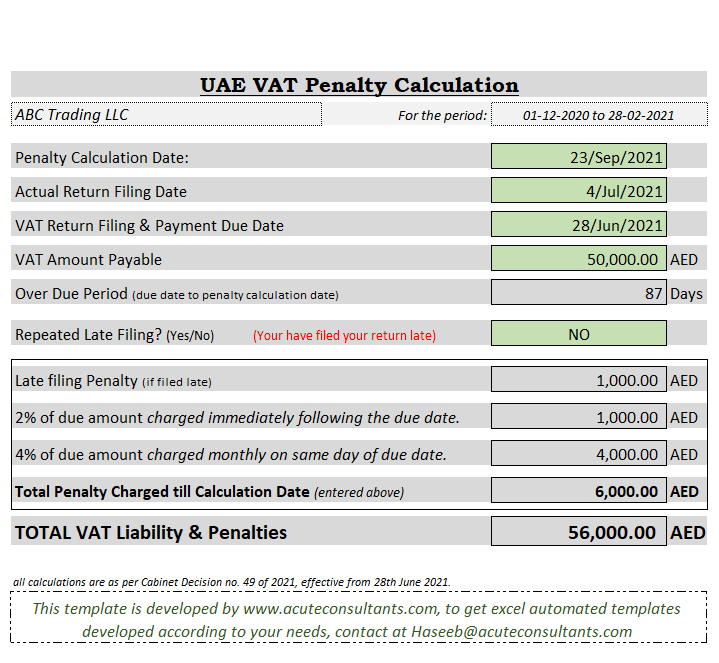

We have developed a tool in MS Excel to help you make it easy to calculate administrative penalties as per cabinet decision 49 of 2021 effective from 28th June of 2021.

Click here to Download NEW UAE VAT Penalty Calculator

A screenshot of UAE VAT Penalty Calculator is attached herewith.

Click here to Download NEW UAE VAT Penalty Calculator

.

The effective date of this new Cabinet Decision no. 49 is 28th of June 2021. So penalties before 28th June 2021 need to be calculated as per old rules and hence above available calculator is NOT for penalties calculation till 28-06-2021.

For Calculation of penalties up to 28-06-2021 you need to have old penalty calculator.

Click here to Download Old UAE VAT Penalty Calculator which calculates administrative penalties as per Cabinet Decision No. 40 of 2017.

Click here for VAT consultation and Return Filing Services at discounted rates

We are offering Free Cloud Accounting Software (QuickBooks or Sage) with all our Bookkeeping Packages, click here to know more about it.

Thanks. it is really a great tool.