Disclaimer: This article expresses the opinion of author, readers are free to express their differences and are advised to exercise their discretion.

UAE marks one successful VAT year.

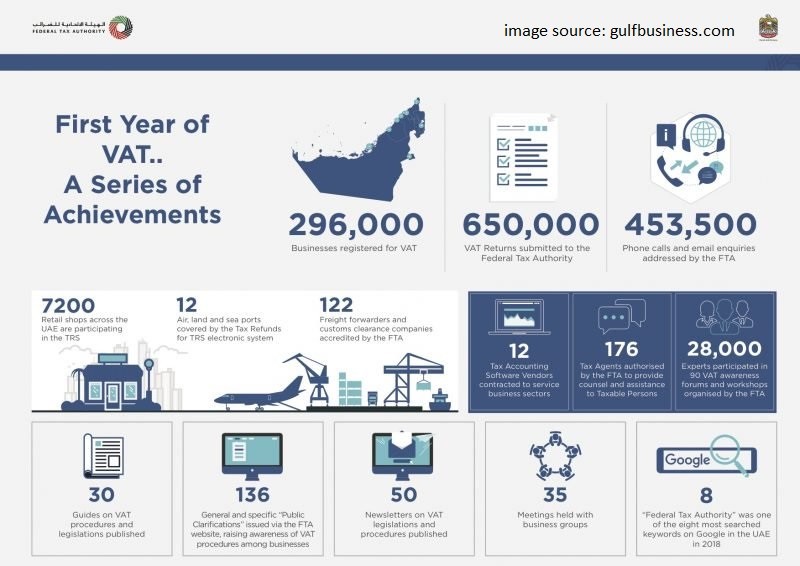

A total of 296,000+ business registered for VAT (Value Added Tax) and 650,000 VAT return were submitted in year 2018.

The authority however did not disclose the targeted revenue of Dh 12 Billion in first VAT year. (Source: Khaleejtimes)

Value Added Tax (VAT) was introduced in United Arab Emirates on January 01, 2018. Now first year is over and I being engaged in social platform and clients noted seriousness from businesses in taking part from registration to returns filing. However, 100% compliance can not be expected in first year of its implementation particularly in a no tax country erstwhile. I would like to shed light on areas where some of business shown poor compliance.

Read and assess how you performed and whether you need to rectify your VAT reports before Tax Audit is started.

1. Accounting system and its configuration:

Though all the business were fully familiar that Value Added Tax is going to be implemented from January 01, 2018 still majority of businesses (especially small businesses) did not equip themselves with tools to support VAT accounting.

It is understood it costs businesses to change accounting system and necessary tools but accounts teams in many of small businesses were even not able to make maximum use of available resources and do VAT accounting in self-explanatory way. It was very much because of lack of practical experience in taxes accounting as UAE was no tax country ever before.

Proper VAT coding and use of right code in right transaction was major problem as many businesses could not differentiate properly between the ‘Exempt’ and ‘Zero Rated’ and ‘Out of Scope’ transaction in their systems which made reconciliation part cumbersome.

2. Input Tax Recovery.

Amongst all this was one of the major issue most specifically in first two return. Input VAT was recovered without having proper tax invoice or even invoice in the name of business. Characteristic of Tax Invoice are set out in Article 59, Tax Invoice and Tax Credit Note of Cabinet Decision No. (52) of 2017 on the Executive Regulations of the Federal Decree-Law No (8) of 2017 on Value Added Tax.

In some cases, it was noticed VAT amount recovered was not matching with the VAT amount charged on Tax Invoice. Businesses are allowed to recover only the amount charged on invoice.

3. Reverse Charge, VAT 201 Box 3, Box 6 ,7 and 10.

The box 6 in your VAT 201 form populates data for the transaction cleared through customs using your TRN. It contains VAT at the rate 5% of value (the value of goods + freight charges + insurance expenses + customs duty).

The data in accounting systems hardly matched with the prepopulated data in box 6 (EY writes the same). There was lack of knowledge about calculation of value on which to apply 5% VAT as freight, insurance and customs duty were not added to the value while recording import transaction and often recorded as expenses without VAT.

Furthermore, an easy step was taken to just copy and paste the values from box 6 to box 10 in VAT 201 form without reconciling with their actual records.

This was also ignored whether they are genuinely allowed to reverse it or not and just reversed it.

Imports of Services were often missed to be recorded as an import transaction. This is the purchase which is not cleared through customs hence not populating in Box 6. Businesses are required to record it as import of services and are allowed to take credit of reverse charge scheme and repot it in Box 3 in their VAT 201 form. This compliance requirement was often missed. Box 7 is for correction and adjustments if values are wrong which is hardly ever case.

Goods imported and declared as ‘imported for re-export’ has nothing to do with VAT return provided they are re-exported. Some reported such transaction via RCM in box 3 or box 7, though it did not affect VAT liability but RCM is for goods imported into the UAE and goods declared as ‘imported for re-exports’ are actually not imported into UAE that’s why not auto populating in box 6. Read Article No. 47 clause 1 of Cabinet Decision No. (52) of 2017 on the Executive Regulations of the Federal Decree-Law No (8) of 2017 on Value Added Tax where general rules regarding imports of goods are set out.

4. Deemed Supply.

This type of supply was ignored at all and could hardly be imagined as taxable supply. For example, in case of a beverages company the drinks consumed by its own staff count as a taxable supply. The requirement to record it as taxable supply at 5% was totally ignored.

5. Differentiation between a supply for business and supply for consumption in Designates Zones.

Supplies of goods between designated zones are out of scope provided the required conditions as set out in Decree Law and Executive Regulations are met. Businesses in designated zones are required to get declaration from customer for the intended use of supply whether it is for consumption or to be used in production. The supplies for consumption are not out of scope but taxable supplies. This requirement was hardly complied in first returns and no differentiation made whether it was taxable or out of scope supply.

Let us take another example of a café or restaurant business, the supplies of such businesses are self-evidently for consumption and are taxable at standard rate though being inside designated zones.

6. Recovery of non-recoverable input Tax.

Article 53 of Cabinet Decision No. (52) of 2017 on the Executive Regulations of the Federal Decree-Law No (8) of 2017 on Value Added Tax explains some expenses where recovery is blocked like entertainment expenses, motor vehicles. Confusions stood with expenses related to cars where input tax was recovered without having concrete evidences of its sole business use. It was much discussed on social platforms that VAT on fuel expenses is not recoverable, though not only fuel but VAT paid on all expenses e.g. purchase, insurance, maintenance etc. was non-recoverable.

7. Emirate wise reporting vs place of supply rule.

Confused with this heading? Let’s understand it. Place of supply rule was often mixed with requirement of Emirate of wise reporting (I came to understand from social VAT discussion platforms).

Place of supply rule is just to ascertain whether UAE VAT will apply or not. It is well explained in Executive Regulations and in publishing of Awareness Session material on FTA website. Place of supply rule has nothing to do with the requirement of Emirates wise reporting of VAT. With the exception to special rules, generally the supplies made out side of UAE are out of scope of UAE VAT and VAT is levied on supplies made within UAE. Once you ascertained that place of supply is UAE, UAE VAT will apply.

Now once ascertained that place of supply is UAE and UAE VAT will apply here comes the time to determine Emirate of place of supply.

FTA states in issued guidelines for VAT return filing “This information should be identified by the Emirate in which that supply was made. For businesses with fixed establishments in the UAE, the supply should be reported in the Emirate where the fixed establishment most closely connected to the supply is located. For non-established businesses, the supply should be reported in the Emirate where the supply was received”.

Let us understand Place of Establishment and Fixed Establishment from Federal Decree Law No. 8 of 2017.

Place of Establishment: The place where a Business is legally established in a country pursuant to the decision of its establishment, or in which significant management decisions are taken and central management functions are conducted.

Fixed Establishment: Any fixed place of business, other than the Place of Establishment, in which the Person conducts his business regularly or permanently and where sufficient human and technology resources exist to enable the Person to supply or acquire Goods or Services, including the Person’s branches.

Confusion remained there in understanding of wording ‘Standard rated supply in emirate of Dubai’. Don’t be get twisted in apparent meaning and hope above paragraph has cleared your doubts.

Let us take an example of a business registered and having place of establishment in Dubai and a branch (fixed establishment) in Ajman and sales are made from both offices to other emirates, say Sharjah. The supplies from Dubai to Sharjah will be reported in form 201 in emirate of Dubai and supplies from Ajman to Sharjah will be reported in emirate of Ajman.

For established business, location of customer is disregarded.

The khaleejtimes writes, the FTA is going to conduct tax audits on businesses, which will ensure that the they take compliance with VAT more seriously than what they have been doing in the first year. In 2019, Khalid Ali Al Bustani, director-general of FTA expects further improvement in tax compliance rates, promote registration among taxable businesses and combat tax evasion.

“The authority is currently working to launch new campaigns, most notably the tax invoice campaign, which is set to take place during the first quarter of 2019 and aims to ensure the use of tax invoices for all business operations,”